A guide to freelancer expenses

Posted on 10th June 2020 by Katherine Ducie

As a self-employed freelancer, there’s a range of expenses that you’re eligible to claim for.

Your expenses are purchases made related to your business such as office equipment, office rent and travel costs.

It’s important to correctly calculate your expenses and deduct them to work out what profit you’re making, as this affects how much tax you’ll pay.

Now that most of us are spending more time working from home, you might discover that there’s extra business expenses you are able to claim for.

What expenses can I claim for while working from home?

When you work from home, you can claim for expenses including:

- Rent or mortgage interest

- Council tax

- Heating

- Electricity

- Water rates

- Property insurance

- Internet or telephone/ mobile phone use

- Security

- Repairs and maintenance of business premises

For amenities like electricity and internet that you use for both business and personal use, you can claim allowable expenses for the business cost.

That means you can expense a proportion of the cost, not the whole cost of a bill. In order to do this, you need to work out what percentage of the bill is attributable towards the running of your business.

For example, if you have a house made up of five rooms with an annual electricity bill of £550 a year, and you use one of these rooms as an office, you can expense a proportion of the bill to compensate for the electricity used in your office – £550 divided by five, equalling £110 a year.

If you work two days a week from home, you can claim back £31.43 a year – £110 divided by 3.5.

Another example would be your mobile phone. If your bill each month is £50 and 30% of your phone usage goes towards making business calls and communicating with clients, you could claim on £15 of business expenses.

HMRC trust your judgement in calculating the proportion of bills that can account for business expenses. It’s still important to be accurate and vigilant, in case you are one day investigated and need to explain your calculations.

Office equipment and property

As well as claiming for bills, you can claim business expenses on office equipment and property. This includes:

- Stationery

- Postage

- Printing

- Printer ink and cartridges

- Computer software your business uses for less than 2 years

Travel expenses

If you’re travelling, you can claim expenses on the following:

- Vehicle insurance

- Repairs and servicing

- Fuel

- Parking

- Hire charges

- Vehicle licence fees

- Breakdown cover

- Train, bus, air and taxi fares

- Hotel rooms

- Meals on overnight business trips

You’re unable to claim expenses for travel between home and work. Fines incurred are also not covered under travel expenses.

Staff expenses

When it comes to individual staff members themselves, you can claim business expenses for the following:

- Employee and staff salaries

- Bonuses

- Pensions

- Benefits

- Agency fees

- Subcontractors

- Employer’s National Insurance

- Training courses that help to improve the skills and knowledge of your business

Self-employed individuals are unable to claim staff expenses for amenities like child care or housekeeping. When claiming expenses for training courses, it must be related to your business.

Training courses claimed for cannot be for the purpose of starting a new business or for the purpose of expanding into new areas of business.

Legal or financial expenses

As a freelancer, you can claim business expenses on the costs you pay in hiring an accountant or paying for the services of a solicitor. If you’ve employed the services of a surveyor or architect for your business, these costs can be claimed on too.

For those with Professional Indemnity Insurance, Public Liability Insurance or any other type of business insurance policy, you can claim expenses for the cost of your insurance premiums.

Professional Indemnity Insurance is crucial to many freelancers, in protecting their business and providing security. Should you ever make a mistake in the work you complete for a client or provide advice that results in a financial loss for them, Professional Indemnity Insurance will cover you if your client make a claim against you. Legal costs and expenses incurred in your defence or compensation paid to the client will be covered by this insurance.

Public Liability Insurance covers you for claims made by members of the public, for injury or damage. This can include customers, clients, suppliers or even passers-by.

As with Professional Indemnity Insurance, Public Liability Insurance will cover costs of your legal defence and any compensation pay-outs. It can also cover medical costs and loss of income, resulting from the claim. To find out more about Public Liability Insurance and reliable all-encompassing business insurance packages, click here.

Other financial costs you can claim expenses for include:

- Bank, overdraft and credit card charges

- Interest on bank and business loans

- Hire purchase interest

- Leasing payments

- Alternative finance payments, such as Islamic finance

As a self-employed individual, you are not eligible to claim for payments including overdrafts and repayment loans or debts not included in your turnover.

Marketing expenses

Marketing is important for many businesses and is often costly. If you’re advertising in printed materials like newspaper or directories, you can claim allowable business expenses. You can also claim for the costs of maintaining your website, free samples and email marketing.

Entertainment expenses

Business expenses cannot be claimed for entertaining either clients, customers or suppliers or for events.

Expenses for subscriptions

If you, like many other freelancers pay to be a member of a professional organisation related to your industry or a trade journal, you can claim expenses.

Subscriptions including gym memberships and charity donations cannot be claimed against.

Clothing expenses

Self-employed workers are unable to claim expenses for everyday wear, even if you need to equip yourself with smart office attire for meeting up with clients.

The only time you can claim expenses for your clothing, is if you wear a uniform or protective clothing. Self-employed actors and entertainers are able to claim expenses for costumes.

Simplified expenses for sole traders

Rather than working out your business costs, simplified expenses allows you to claim back some of your expenses using flat rates, set by HMRC.

This method of calculating business expenses can be used by both sole traders and business partnerships, which have no companies as partners. Simplified expenses cannot be used if you operate a limited company.

You can use these flat rates for expenses covering:

- Business costs for vehicles

- Working from home

- Living in your business premises

To use simplified expenses, you need to keep a record of the hours you work from home and provide information on how many other individuals live at your business premises over the year. If you use a car or other vehicle to run your business, you need to record your business miles to claim on this.

At the end of the tax year when submitting your self-assessment tax return, you will need to add up all of these expenses using the flat rates.

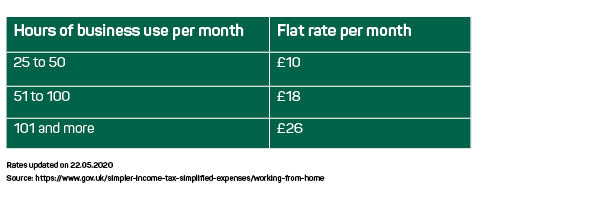

Sole traders working from home

When your calculating your working from home expenses using the below flat rates, bear in mind that telephone and internet expenses are excluded. For these, you will need to calculate the actual business cost.

To claim using simplified expenses, you must work 25 hours or more from home.

Vehicles

If you’re a sole trader using a vehicle to travel for work, you can calculate flat rates for your mileage, rather than working out the actual costs of buying and running your vehicle.

Note that, if you have already claimed capital allowances for your vehicle, you’re unable to claim simplified expenses for the same vehicle.

If you do use flat rates for your vehicle, HMRC do specify that you must carry on using flat rates for as long as you use your vehicle for business.

As well as using flat rates for your mileage, you can still claim for other travel expenses, like parking or train journeys.

If you’re unsure of whether using simplified expenses or working out the actual cost is a better option for you, try using HMRC’s simplified expenses checker.

Limited companies working from home

If you run a limited company and work from home, you can calculate your home office expenses using HMRC’s allowance guidelines for the extra costs of running your business from home.

Through your limited company, you can claim up to £6 a week as an allowable expense along with the other expenses you’ll be claiming for. Receipts as proof are not needed to do this.

If you think your costs are going to be a lot more than this, you can calculate the actual proportionate cost, used by your business. If you’re choosing this method, make sure your calculations are fair and honest.

The alternate option for limited companies is to rent your home office to your business. This option can in some cases mean claiming more money. To do this, you must have a rental agreement in place between you as the homeowner and your limited company, signed by both parties. You also need to ensure that the rental price set is fair to both you as the homeowner and the limited company.

Making a claim and keeping track of your expenses

When it comes to processing your claims, it’s important to have a record of all your business expenses for that tax year. This will provide proof of your costs, should they need to be justified.

You can keep on top of your expenses, by recording them in a spreadsheet as you go along or by using a simple app like Quickbooks.

When you submit your tax return, you won’t be asked to attach proof of your expenses. It is still crucial that you keep proof of records and receipts, in case HMRC do contact you. You’ll need to keep these expense receipts for six years. HMRC can choose to investigate claims made up to six years prior.

If keeping paper copies of all your receipts over a six-year period becomes too much paperwork, you can always scan your receipts or take photos of them as evidence. Make sure you have a back-up copy of these files to safeguard you against any technology glitches.

Once you have a record of all your allowable expenses for that tax year to hand, you’ll need to add up these figures and calculate the total cost on your Self Assessment tax return.

Tax Enquiry and Legal Expenses Insurance for Freelancers

In circumstances where your taxes are investigated by HMRC, holding Tax Enquiry and Legal Expenses Insurance can protect you from having to pay for legal representation yourself.

Related articles

What type of training course counts as an allowable expense?

If you would like a quote for your business insurance, please call our friendly award-winning team on 0333 321 1403 today, or click to get a quick online quote in minutes!

Click here for a quick online business insurance quote

Sources

https://www.gov.uk/simplified-expenses-checker

https://www.gov.uk/expenses-if-youre-self-employed

https://www.gov.uk/expenses-if-youre-self-employed/office-property

https://www.gov.uk/expenses-if-youre-self-employed/travel

https://www.gov.uk/expenses-if-youre-self-employed/clothing

https://www.gov.uk/expenses-if-youre-self-employed/staff

https://www.gov.uk/expenses-if-youre-self-employed/legal-financial

https://www.gov.uk/expenses-if-youre-self-employed/marketing-entertainment-subscriptions

https://www.gov.uk/expenses-if-youre-self-employed/training-courses

https://www.gov.uk/expenses-if-youre-self-employed/how-to-claim

https://www.gov.uk/simpler-income-tax-simplified-expenses

https://www.gov.uk/simpler-income-tax-simplified-expenses/working-from-home

https://www.gov.uk/simpler-income-tax-simplified-expenses/vehicles-

https://www.gov.uk/self-assessment-tax-returns

https://quickbooks.intuit.com/uk/