As a private sector contractor operating through a Personal Service Company (PSC), you can’t afford to wait until April 2021 to deal with the IR35 changes, you need to fully appreciate your tax position and your IR35 status now.

If you’re looking for a definitive checklist with a simple answer, unfortunately IR35 isn’t that straightforward and HMRC will look at a range of areas to determine employment status.

How the Ready Mix Concrete case of 1968 defined contract of employment

Back in 1968, the Ready Mixed Concrete case determined three key factors which create a contract of service (employment):

- The individual is obliged to provide the services personally (personal service)

- The individual is subject to control by the engager as to how they provide the services (control)

- An obligation must exist on the engager to provide work and an obligation on the individual to undertake the work. (Mutuality of Obligations)

Therefore, it follows that if any of the criteria in points 1 to 3 below is missing, the contract cannot be a contract of service and is more indicative of a contract for services (self-employment).

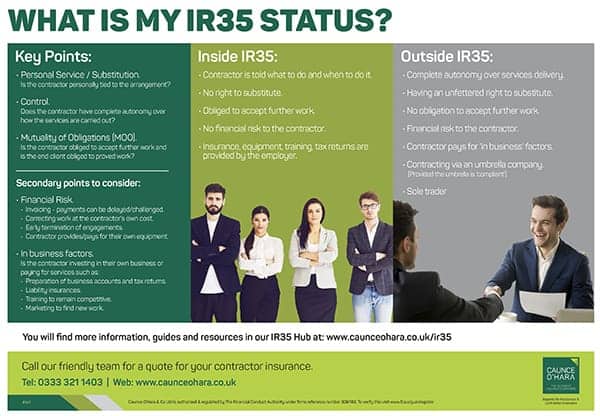

Points to consider for each:

Personal service/the right of substitution

- Does the engagement require that individual’s personal service? Are they a named party in the contract?

- Does the contract provide a genuine right to send a substitute?

- Can the client refuse the substitute only if they lack the necessary skills qualifications and experience?

- Does the original contractor remain part of the contractual chain?

All too often substitution clauses only offer a right to substitute in limited circumstances and then only with the client’s permission; effectively, the client is determining who does the work.

Control

- Does the contractor have complete autonomy over how the services are carried out?

- Or does the end client have a right to exercise control (whether they do so or not)?

- Is the contractor obliged to follow client procedures/methodology.

It is not unusual to read terms which only offer the contractor ‘reasonable autonomy’ over how the work can be undertaken or contain prescriptive clauses around working practices and policies which impact on how the services are provided.

Mutuality of obligations (MOO)

In order to determine a lack of mutual obligations, one is looking for:

- No obligation for further work to be offered or accepted.

- No obligation to offer or accept additional work outside the scope of agreed services.

- No obligation for the contractor to see the engagement through to completion.

- No requirement to be present on any particular day.

- No obligation for the agreement to be extended.

The reality is that MOO is the hardest of the three key factors to argue, although it has been prominent in deciding recent status cases. Nevertheless, unlike HMRC, tax advisers still view it is a factor to be considered and argued.

Ready Mixed Concrete determined that the above three factors should be primarily used to determine status, but secondary factors need to be reviewed where the primary factors do not offer clarity. In an IR35 Tribunal a judge will also consider the secondary factors below to build a complete picture.

Secondary points to consider:

In business factors

Is the contractor investing in their business or paying for services such as:

- Preparation of business accounts and tax returns

- Liability insurances

- Training to remain competitive

- Marketing to find new work

Financial risk

Examples of taking financial risk would include:

- Invoicing, as invoices can be delayed, challenged or ultimately not paid.

- Correcting defective works at the contractor’s own cost.

- Early termination of engagements – contractors may have (usually short) notice periods, but even then if the contractor is not given work to do, they won’t get paid.

- Provision of equipment – a contractor working for a PSC will likely purchase a laptop, server, printer, office equipment and stationery.

If a freelancer wants to be seen as an independent contractor, it is important they can demonstrate in business factors; the level of financial risk is often determined by the contractual terms.

Your IR35 status from 6 April 2021

From 6 April, medium and large sized end clients will have the responsibility to determine the IR35 status of an engagement. As a contractor, if you do not agree with the status determination, you have a couple of options:

- Discuss the engagement with your client before they issue a status determination:

- Has the client decided how they will engage contractors in the future?

- Is the client willing to work with the legislation?

- Can you impress upon your client the value of your company’s services to them?

- Can you demonstrate that your engagement is currently outside of IR35, so that it continues on the same basis after April?

If the client takes the view that they will no longer engage PSCs, then your options are limited; but if they are willing to work with the legislation, then you have the opportunity to influence the outcome.

You can do this by having an independent contract review, which will not only assess the current position, but will offer your client evidence that they can use to demonstrate that they have taken reasonable care when making their decision.

- Client-led disagreement process:

- The end client is obliged to implement its own disagreement process to allow the contractor to raise any objections to the Status Determination Statement (SDS) which they are obliged to issue on each and every engagement.

- The legislation doesn’t provide prescriptive steps on what this process should look like, but it does impose a 45-day time limit for the end client to respond to the PSC’s disagreement with the SDS.

- The end client must then either: confirm its existing decision along with its reasoning, or issue a new SDS along with its updated reasoning.

- If a new SDS is produced, then it must be delivered to the relevant parties.

- If the end client fails to provide its reasoned response within the 45 days, it holds the position of fee payer for the purposes of the legislation.

What is my IR35 status if I work for an umbrella company?

Many more contractors are now working as umbrella company employees than would have been the case prior to the public sector changes in April 2017 and as a result of a number of end clients – particularly in the banking and financial services sectors – taking decisions not to engage PSCs last year and sticking to those decisions even though the off-payroll changes were deferred until this year.

As a contractor working for an umbrella company you could be working on contracts that are technically inside IR35 and the next contract you work on could technically be classed as outside IR35. Either way, IR35 status will not be relevant to you as you work for an umbrella company. As you are an employee of the umbrella company, you will be paying tax and National Insurance in the same way as a full-time company employee.

Working for an umbrella company means reduced take home pay because the company will deduct its margin for providing its services from the day rate and must also include PAYE and NIC deductions. This means you will pay more tax than you would if you were working through a PSC on an engagement outside of IR35. However you may not have the luxury of working through your PSC in the future.

What is most important is to ensure the umbrella company you work for is ‘compliant’. The moment you read a statement such as “Take home 85% of your pay” or you are being offered a loan or told your funds will be diverted offshore to minimise tax; or you are asked to pay fees to enter a scheme, then it is time to question how and why the tax position can be so beneficial. Thousands of contractors have already established that it can’t and have big tax bills as a consequence.

You must also remember that HMRC do not approve arrangements that claim to avoid tax payments or boost take home pay. So, anything that says “HMRC Approved” is just simply not true.

Caunce O’Hara offer a range of business insurance solutions to help contractors stay protected including Tax Enquiry & Legal Expenses Insurance, which provides cover for costs incurred by a HMRC investigation. Tel 0333 321 1403.

Markel Tax offer specialist IR35 tax services to help end client decision-makers ensure they are compliant with the legislation. Agencies who may be concerned about their fee payer liability can also consider insurance. To find out more, please contact Markel Tax on 0345 223 2727.